When we discuss cryptocurrencies, the word “exchanges” usually surfaces as the point of origin for venturing into that realm.

But have you ever thought about how these exchanges function and what their function in cryptocurrency trading is?

In fact, there are two broad categories of exchanges: Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). Although they both seem to do the same thing—enable the buying and selling of cryptocurrencies—their functioning varies significantly.

Why should that be important to you? Because selecting the correct one can affect the security of your money, the speed of making trades, and ultimately, the degree of freedom you enjoy when trading.

In this article, we will discuss in detail the CEX vs DEX, the differences between centralized and decentralized exchanges, how they work, and how to choose the right one for you.

What is a Centralized Exchange (CEX)?

We will begin with centralized exchanges, the most popular and prevalent platform today. If you have ever had experience with platforms such as Binance, Kraken, or Coinbase, then you have already had contact with a centralized exchange.

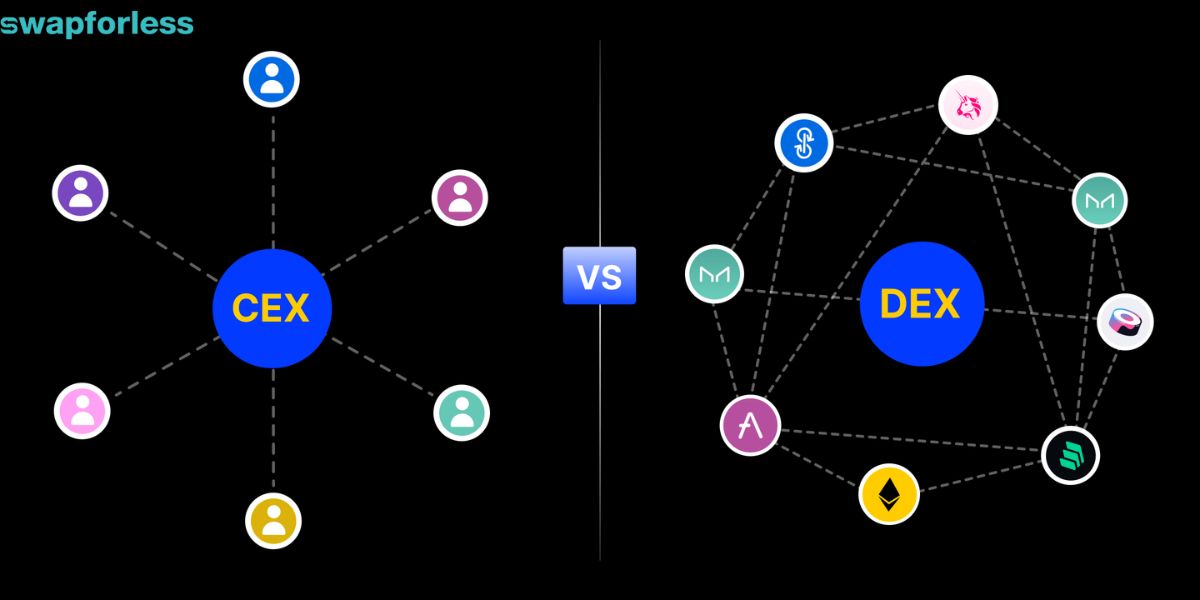

These exchanges have a central intermediary that oversees their operations. This intermediary not only records transactions but also offers liquidity and handles users’ accounts for them.

That is, when you put your money on a centralized exchange, it is not in your control. Rather, they’re held in wallets controlled by the associated company.

How Are Trades Executed?

In a CEX, transactions are made using what’s called an Order Book. It matches up buying with selling using available prices.

Suppose, for instance, that you’d like to buy Bitcoin at a particular price.

The system will scour for a seller accepting that price and will automatically carry out the transaction. What makes such a system effective is how fast it works.

It takes mere seconds for a trade to be made due to the solid infrastructural services offered by the businesses that manage such exchanges.

What is a Decentralized Exchange (DEX)?

Decentralized Exchange, abbreviated as DEX, is Decentralized exchanges are one of the most revolutionary breakthroughs in blockchain technology.

If you’ve heard of platforms like Uniswap and SushiSwap, you’re already familiar with them.

These exchanges have no central intermediary. Rather than trusting a company with the handling of trades, DEXs rely on smart contracts to enable transactions among users.

To become more familiar with what smart contracts are and how they function, read our elaborate article here: What Are Smart Contracts? A Practical Guide in 2025

Trades occur directly between users, making the transactions more transparent and less dependent on trusting a third party.

How are trades executed?

Trades are coordinated using smart contracts on a DEX. For example, if you wish to buy a particular cryptocurrency, you instruct the smart contract with your buy order.

The trade will be made once conditions have been fulfilled (e.g., when there is a seller available and the agreed sum).

DEXs depend on Liquidity Pools too, where users lock up their funds in communal pools in order to facilitate automatic exchange. For their participation, they get a portion of the transaction fee.

The main benefit is that funds do not go through a central middleman; they stay in users’ individual wallets during the entire transaction.

This provides users with more control over their funds and minimizes the risks of exchange hacks.

CEX vs DEX: The Difference Between Centralized and Decentralized Exchanges

Now that we understand how each type of exchange works, let’s compare the differences between CEX and decentralized exchanges in more detail.

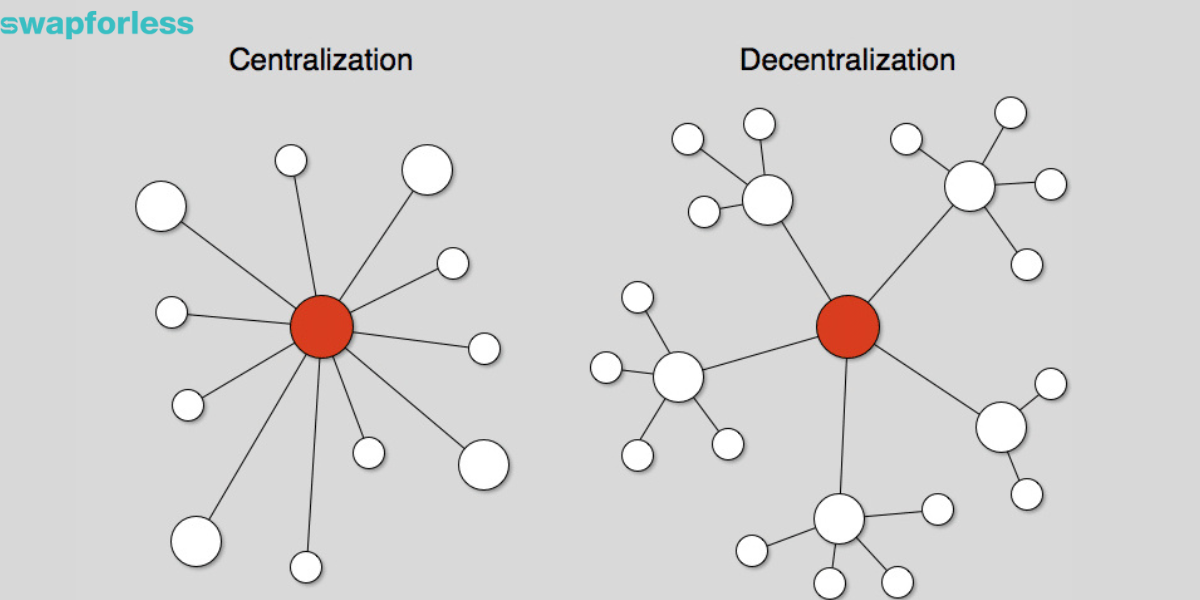

Core Structure:

- A centralized exchange operates with a central authority and uses a third-party intermediary to facilitate transactions between buyers and sellers. The intermediary manages the assets and ensures trades are executed correctly.

- On the other hand, a decentralized exchange operates without intermediaries and never holds users’ cryptocurrency assets.

Instead, transactions are based solely on smart contracts and atomic swaps, allowing trades to happen directly between users without the need for a middleman.

Types of Tradable Assets:

- Centralized exchanges allow you to trade fiat currencies (like the US dollar or euro) for digital assets. This feature makes them the preferred choice for beginners who want to enter the crypto world using traditional money.

- Decentralized exchanges, however, are often limited to swapping one digital asset for another. This means you need to already own cryptocurrencies to trade on a DEX, which can be a challenge for new users.

Privacy:

- Centralized exchanges store your personal data on their servers, making them vulnerable to breaches. If an exchange is hacked, your private information could be exposed.

- Decentralized exchanges, on the other hand, offer a higher level of privacy. Most DEXs don’t collect or store personal data. All transactions occur directly between users via smart contracts, making it much harder for scammers to access your information or steal your funds.

Security:

- Funds on centralized exchanges are stored in centralized wallets, making them prime targets for hackers. We’ve seen several high-profile breaches, such as the collapse of FTX, which resulted in users losing millions of dollars.

- Decentralized exchanges are considered safer because they don’t store funds in centralized wallets. Instead, funds remain in users’ personal wallets, meaning you’re solely responsible for securing your private keys.

Fees:

- Centralized exchanges generally perform better when it comes to fees and speed. CEX fees are usually lower due to high liquidity and robust infrastructure.

- Decentralized exchanges, however, rely on blockchain networks to execute trades through smart contracts. This means you’ll pay gas fees for every transaction, which can vary depending on the blockchain network. These fees can become very high, especially during periods of network congestion.

Speed:

- Centralized exchanges are much faster at executing trades, often completing transactions within seconds thanks to their strong infrastructure and high liquidity.

- Decentralized exchanges can be slower, as they depend on smart contracts and blockchain networks. During times of network congestion, delays in trade execution can occur.

Challenges Associated with Centralized and Decentralized Exchanges

Problems Associated with Centralized Exchanges (CEX):

- Hacking Risks: One of the biggest challenges facing centralized exchanges is the risk of security vulnerabilities and hacking. Despite significant investments in security measures, cyberattacks remain a major threat.

- Privacy Concerns: Centralized exchanges collect personal data from users to comply with regulatory requirements, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. While this is necessary for legal compliance, it forces users to sacrifice a degree of their privacy.

- Market Manipulation and Lack of Transparency: A key issue affecting some centralized exchanges is the lack of transparency, which can lead to market manipulation. Since these exchanges control the entire trading process, they have the ability to manipulate transaction records and trade volumes to influence prices in their favor.

- Trust Issues: When using a centralized exchange, you must place full trust in the company managing your funds. If internal issues arise or the company collapses, you could lose your money entirely.

- Regulation: Some countries impose strict regulations on centralized exchanges, which can limit user freedom and flexibility. These regulations may also create barriers for users in certain regions.

Problems with DEX:

- Complexity: DEX interfaces are often complex and not beginner-friendly. Without a technical background, it can be challenging to understand how to use them.

- Low Liquidity: It can sometimes be difficult to find buyers or sellers quickly, especially for less popular cryptocurrencies.

- High Costs: High fees on DEXs can be a barrier for new users, particularly when using congested networks like Ethereum.

- Smart Contract Vulnerabilities: For example, in 2021, the Poly Network was hacked due to a vulnerability in its smart contract, resulting in the loss of $611 million worth of cryptocurrencies. Fortunately, most of the funds were later recovered, but the incident highlights the risks associated with relying entirely on smart contracts.

Conclusion:

Deciding between using a decentralized and a centralized exchange hinges on what you value. If convenience and quick exchanges are most important, centralized exchanges will probably be the way to go.

But if security and privacy are your top priorities, decentralized exchanges are where you want to be.

You ask a tough one! There isn’t a right or wrong answer—it really depends on your needs and what works best for you.

If you are new to the field, do not hurry. Spend time learning and experimenting with both exchange types. Investing in cryptocurrencies, after all, is a path where patience and thorough research are necessary.

swapforless blog

swapforless blog