PayPal, electronic banks, and electronic money transfer services: What are they? You may be wondering about these questions, especially if you are one of the freelancers working online. PayPal has become a popular way to pay and receive money. So, let us explain to you in the following paragraphs all the details about PayPal to form a clear and accurate picture of it.

PayPal overview

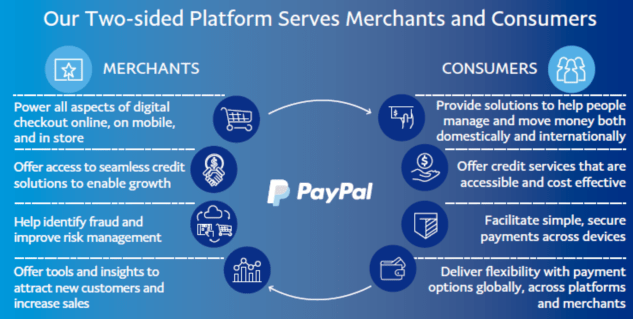

PayPal is a US-based company that has gone global. Founded in 1998, it has become the world’s leading provider of electronic money transfers. PayPal offers safe, secure, and fast ways to shop online and transfer money between accounts.

PayPal is a widely accepted online payment method. It is so popular that it is hard to find an online store or freelance website that does not accept PayPal payments. PayPal offers a number of advantages over traditional banking, including convenience, security, and international reach.

PayPal and online shopping

We are all familiar with the use of ordinary wallets. PayPal is an digital wallet that allows you to store your money safely and securely. You can store cash, credit cards, coupons, and other in your PayPal wallet. You can also choose to pay with cash or by card when making a purchase. PayPal supports multiple currencies, so you can shop around the world. And best of all, PayPal is 100% free to use.

PayPal for online sellers

If you own an online store or are a freelancer who needs a way to receive payments, PayPal makes it easy. The transfer to your account will only take a few moments.

It is essential that you offer your customers the option to pay with PayPal. It is the most popular payment method in the world and is easy to use. Some customers may choose not to work with you or use your services if you do not offer PayPal as a payment option. They may go to someone else who makes it easier for them.

Therefore, you should create and activate a PayPal account.

PayPal and the competition in online payment services

When it comes to the best online banking platforms, PayPal is a must-mention. In fact, it is the undisputed leader in this field. PayPal CEO Dan Schulman said in a speech at the JPMorgan conference in New York last September that the platform has 500 million active users. This is an incredible number, equivalent to the popularity of a major football player like Ronaldo or Messi. In addition, PayPal processes more than 20 billion transactions annually.

PayPal from a cyber security perspective

PayPal’s slogan is “Complete Security.” When you use PayPal to transfer money, all of your funds are protected within the company’s wallet. This is great for protecting your privacy, as the sender of the money to you will only receive your shipping address, name, and email address.

As a result, your sensitive information such as your bank account numbers, security codes, transfer records, sender and recipient addresses, and credit card numbers are all kept private. PayPal also logs your IP address each time you log in to the platform to protect you from hacking in case someone tries to forcibly log in to your account from a remote location.

In addition to many other security measures, such as fingerprint authentication, a PIN code, two-factor authentication via email, and many other ways to ensure that you have a completely secure use of money transfer through PayPal.

Opinions of Internet users in the Arab world

For any Arabic freelancer, PayPal can be both a blessing and a curse. On the one hand, freelancers from the Gulf States and North Africa can easily withdraw their payments from PayPal without any problems. On the other hand, freelancers from a number of Arab countries (such as Syria and Iraq) are prohibited from withdrawing their money from PayPal due to sanctions against these countries.

Although there are many options for withdrawing money in banned countries, PayPal remains the most popular and convenient option for a number of reasons, including:

- Many Arabic and international freelance platforms only accept PayPal for payments to their beneficiaries.

- PayPal is the most widely used and accepted payment method in Arab and online virtual stores. Without an activated PayPal account, you may be unable to shop online at many stores.

- • PayPal is a popular choice for sending and receiving electronic money transfers because it offers lower transfer fees than its competitors.

How to create a PayPal account

To sign up for a new PayPal account, you’ll need a phone number and email address. Once you have those, follow the steps in the video below to activate your account.

A video tutorial on how to create a PayPal account correctly

How to use PayPal in banned countries

PayPal is banned in many countries, including Syria, Lebanon, Iraq, and Turkey. However, it is possible to circumvent these laws by creating a fake account with false information using a proxy or VPN.

However, this method is full of risks. The company may discover your actions and ban you, and even seize your balance. To follow this method, follow the steps shown in the video.

To conclude, we urge the reader to obtain an electronic PayPal account. This has become a pressing necessity in this era. In return, you will achieve ease of transactions, payments, and financial dealings, whether with sellers and buyers in person or online.

Also read: Through swapforless website, you can send to 7 digital wallets.

swapforless blog

swapforless blog