In this article, we will explain How to exchange from Visa to Perfect Money and benefit from their features.

We will highlight the basics of Visa cards and their common uses, in addition to the advantages and disadvantages of Perfect Money accounts and different exchange methods.

Let’s learn together about these financial services and understand How to benefit from them in the best possible way.

What is Visa card, its advantages and disadvantages

:max_bytes(150000):strip_icc()/522421671-5bfc38d946e0fb00517f989a.jpg)

Visa is one of the most popular credit cards in the world, and it is a primary payment method for users in many countries. Visa cards are available in a variety of types and features, making them suitable for the needs of different users.

They offer many benefits that make them an ideal choice for many individuals and businesses.

- Ease of access to funds at any time from anywhere in the world

- The ability to conduct electronic financial transactions securely and conveniently.

- The company provides loyalty programs, discounts, and promotions that can be utilized in many stores and shops. This helps to attract customers.

- Visa cards help reduce online fraud and protect cardholder data. Therefore, it can be said that Visa cards are the best option for a secure and convenient financial experience.

- Visa offers a variety of options for users, including credit cards, debit cards, and prepaid cards.

Although Visa cards offer many advantages and benefits, there are some drawbacks to consider when using the card.

These disadvantages include:

- Additional fees: Banks and card issuers may charge additional fees, such as monthly usage fees, cash withdrawal fees, or currency conversion fees.

- High Debt: Using a Visa card can lead to debt accumulation due to high interest rates if payments are not made on time.

- Fraud and Theft: Credit cards may be subject to fraud or theft, so it is important to be aware of any unusual activity on your card account and report it immediately.

- Non-Acceptance in Some Regions: Visa cards may not be accepted in some regions or countries that use different payment systems. Therefore, it is important to inquire about the card’s acceptance network before traveling.

- Excessive Spending: Frequent and unconscious use of the card can lead to excessive spending and debt accumulation.

It is essential to use a Visa card carefully and not overspend, and to pay attention to the benefits and drawbacks when choosing a credit card.

What is Perfect Money and its pros and cons?

Perfect Money is a well-known electronic payment solution for online transactions, providing a variety of advantages to users.

In this section, we will explore the pros and cons of Perfect Money wallets.

ِAdvantages of Perfect Money Wallet:

- Ease of use: Perfect Money Wallet is characterized by a simple and easy-to-use user interface, making it easy to access account information and perform financial transactions.

- Security: Perfect Money Wallet is highly secure, as all financial transactions are encrypted and protected by modern security technologies, ensuring the confidentiality of the user’s personal and financial information.

- Multiple deposit and withdrawal options: Perfect Money Wallet offers a wide range of deposit and withdrawal options, including bank transfers, credit cards, and many other electronic payment services.

- Technical support: Perfect Money Wallet has 24/7 technical support, making it easy to get help in the event of any problems or inquiries.

Disadvantages of Perfect Money:

- Fees: Some deposit and withdrawal options incur additional fees, and monthly fees may apply in some cases.

- Wallet restrictions: There are some restrictions on the use of Perfect Money wallets, such as daily transaction limits and maximum account balances.

Overall, Perfect Money wallets offer many advantages that make them an ideal option for people who operate in the global market. However, it is important to consider the potential disadvantages and evaluate them carefully before deciding to create a Perfect Money wallet.

3 Steps to exchange from Visa to Perfect Money via swapforless

If you are using a Visa card and want to exchange from Visa to Perfect Money, you may want to use the swapforless service.

This website provides a money exchange service between different e-currencies, including Visa and Perfect Money. To exchange from Visa to Perfect Money, follow these steps:

- Register on swapforless. You must register on the website to create your own account. After registration, you will need to verify your account via the email you will receive from swapforless.

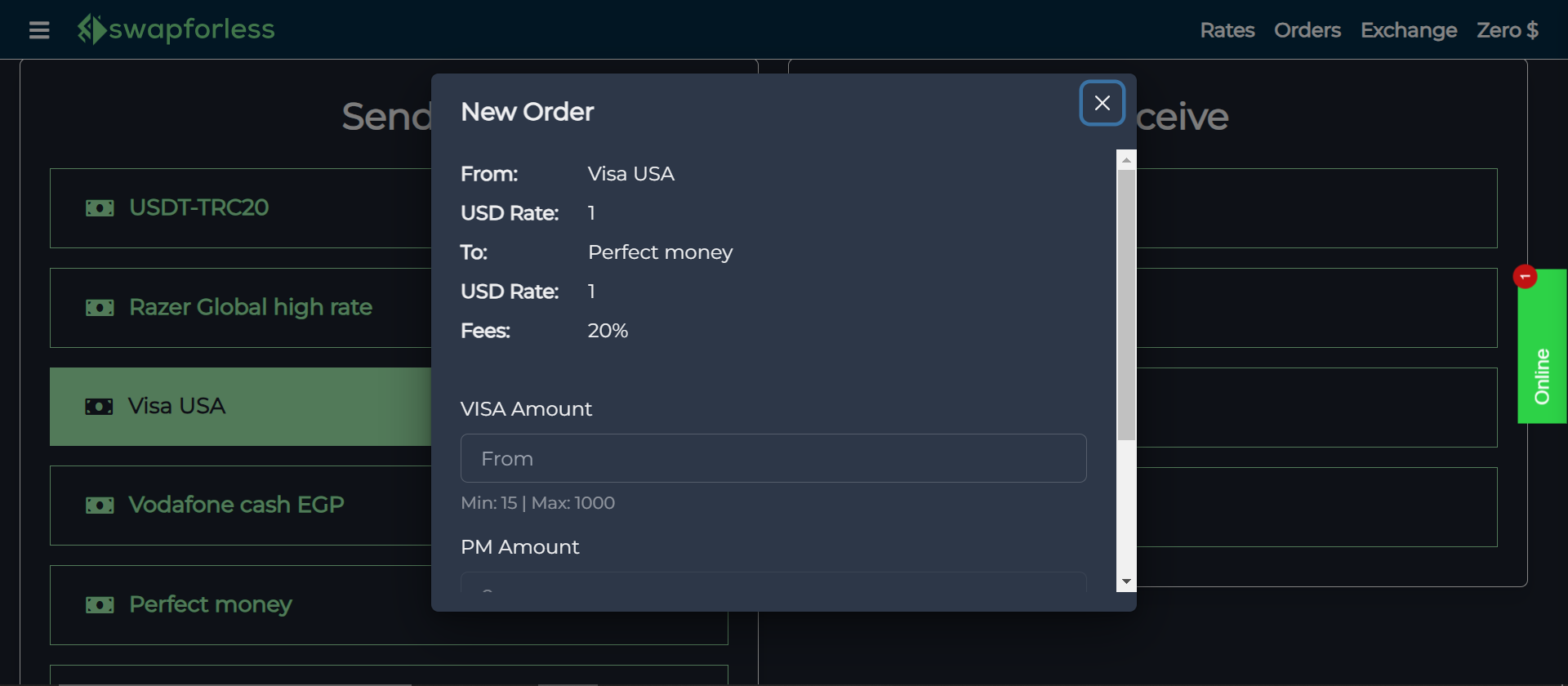

- From the main interface, select Visa from the send section and Perfect Money from the receive section.

- Add the necessary information such as the transfer amount and Perfect Money account number.

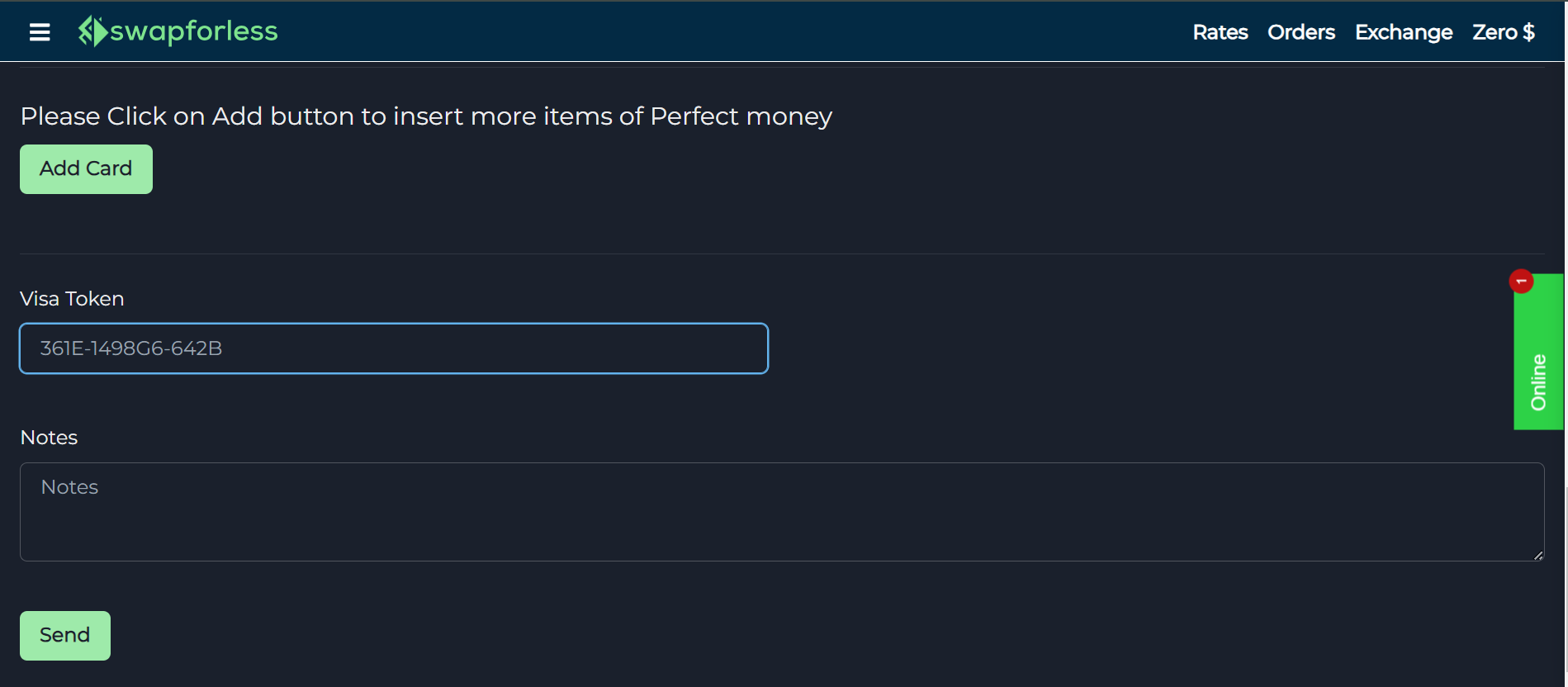

- You will be redirected to another page to add some required information, namely (Visa Token).

Notes:

- This request is processed manually.

- The expected processing time for the request is 1-6 hours, depending on the size of the request.

- Please make sure that all entered information is correct. (Incorrect information may lead to the cancellation or delay of the request.)

You can now take advantage of swapfroless services to exchange money easily and quickly from Visa to Perfect Money.

Remember that these steps are easy and quick and save a lot of time and effort in exchange from Visa to Perfect Money.

Finally

With swapforless, you can now easily and quickly exchange money from Visa to Perfect Money, an important step for many individuals in the e-commerce world.

Therefore, we recommend following these steps and using this service to save the effort and time required to exchange from [Visa] to Perfect Money. By using [swapforless], you can enjoy a fast, secure, and reliable service in your conversion operations, making it easy and efficient to convert between electronic currencies.

Start today and switch to exchange from Visa to Perfect Money via swapforless

Sincerely, swapforless blog team

swapforless blog

swapforless blog