Were you aware of decentralized finance (DeFi) and wondering how it could revolutionize the way we handle money?

Suppose you think the traditional banking system is the only option you have. In that case, it’s time to discover a whole new world of money services that operate without the need for banks or intermediaries.

Here, we will be taking you on a journey about what is DeFi (decentralized finance), how it works, what are its most important use cases, and how you can get started step by step.

What is DeFi (Decentralized Finance)?

Decentralized finance, or DeFi, is a financial system that utilizes blockchain and smart contracts to create open financial services that are accessible to everyone without involving any middlemen.

Its underlying mission is to restore power over finances to the masses so that everyone with an internet connection is able to leverage facilities like lending, borrowing, trading, and even earning on deposits.

So why is DeFi revolutionary? It is revolutionary since it reshapes the traditional financial system.

In the real world, banks and other financial institutions act as intermediaries between people. This means you have to trust the intermediaries, who charge hefty fees and impose rules you must follow.

In contrast, DeFi is free of any middlemen, so you get to keep your money and be in full control of it, and you can make transactions safely and efficiently.

How Does Decentralized Finance Work?

To understand how decentralized finance (DeFi) operates, we need to talk a little about the technologies that it’s built upon: blockchain and smart contracts.

- Blockchain: It is a digital, decentralized, and distributed record that contains all transactions securely and transparently. Data is held in “blocks” that link to each other through cryptography, with each block containing data regarding the previous one, creating an immutable chain of data.

- Smart Contracts: They are programmed codes that function when certain conditions are met. They are programmed in coding languages and implemented in a decentralized setting on the blockchain network.

For example, in the scenario where you want to lend a sum of money, the smart contract will ensure that the receiver is not able to access the money until the conditions agreed on have been met.

When you combine both of these technologies, you have a system whereby you can conduct transactions automatically and transparently without the need for any intermediaries.

This is where you can conduct activities like lending, borrowing, or even trading without the need to involve a bank clerk or documentation.

But how does this work in practice?

Suppose you wanted to lend $100 worth of cryptocurrency to someone. Under the old system, you’d have to go to a bank to do it, and it might take days to get approval.

With DeFi, you just put your money into a lending protocol like Compound or Aave, and the smart contract will do the rest. Once the borrower repays the loan, you receive your money with interest directly in your digital wallet.

Key Use Cases of Decentralized Finance

- Lending and Borrowing:

Aave and Compound enable users to lend and borrow digital assets without having to resort to traditional banking. They offer better returns on savings compared to the traditional banking system, thus becoming a preference for investors. - Decentralized Trading:

Instead of doing business on central exchanges, you can trade on decentralized trading exchanges (DEXs) like SushiSwap or Uniswap. With these exchanges, you trade directly with other users without an intermediary, so you will not be required to deposit your money into a third-party account. - Digital insurance:

There are also include DeFi apps that are specifically geared towards providing insurance services. For example, some protocols, like Nexus Mutual, offer insurance solutions that allow users to buy insurance coverage without having to rely on traditional insurance providers. - Yield Farming and Liquidity Provision:

Users can participate in pools on exchanges like Yearn Finance by providing liquidity. They receive incentives in the form of rewards that encourage increased market liquidity and enable users to generate passive income. - Payments:

DeFi facilitates cheaper and quicker payments, particularly across borders. It eliminates the need for middlemen and offers quicker execution

Staking 2025: Win from Staking and Increase your wallet

Key Features of DeFi Applications

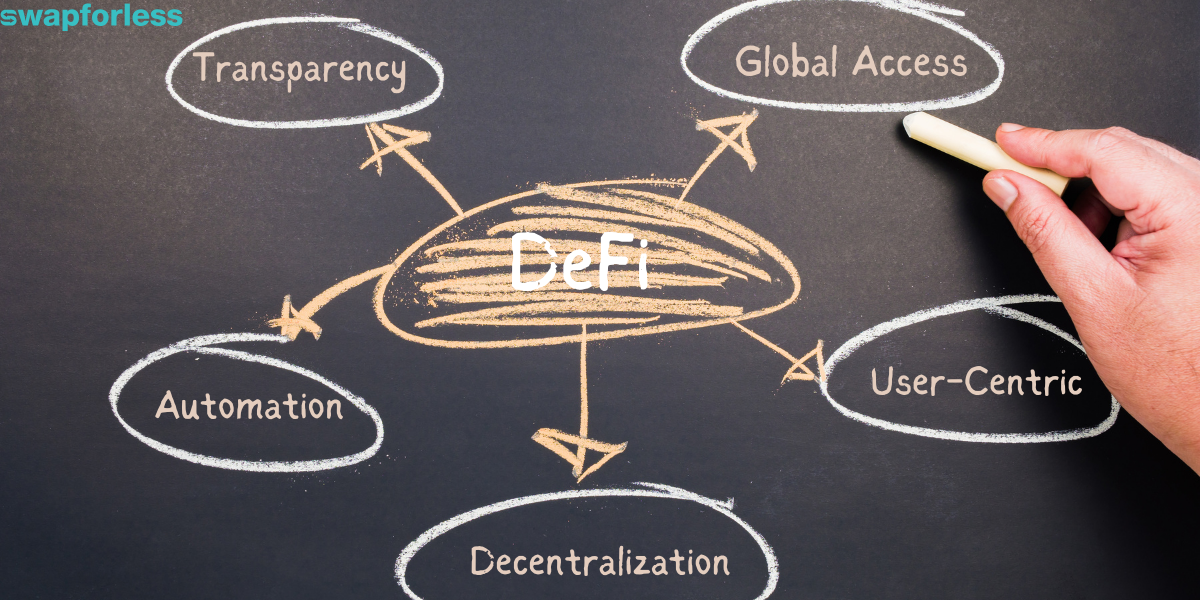

Why is decentralized finance so popular? Due to the characteristics that make it stand out from the traditional financial system:

- Decentralization: No central entity manages the system. All transactions happen on decentralized networks, so you don’t have to trust any person or institution—you just have to trust the code and the network.

- Transparency: Every DeFi transaction is recorded on the blockchain and is traceable by everyone.

- Global Access: You don’t need a bank account or internationally recognized ID to get started. All you need is an internet connection and a DeFi platform.

- User-Centric: These apps focus on giving control to the individual, enabling them to manage their assets themselves without depending on third parties.

- Automation: Smart contracts automate everything without any manual intervention. This makes it possible to get a loan without having to wait several weeks; the loan will be automatic when the terms are met.

How to Engage in DeFi

To start your DeFi experience, you need to perform a couple of simple steps:

- Define Your Objective: Determine your goals first. Do you want to lend, borrow, swap, or earn income by providing liquidity?

- Have your own digital wallet: The first thing you will need is a digital wallet that supports decentralized applications. Your digital wallet will be your access point to the DeFi universe.

- Purchase Cryptocurrencies: You’ll need to own some cryptocurrency to use within the application. You can purchase them from centralized exchanges like Binance or Coinbase.

- Select the appropriate platform: Go to DeFi platforms like Aave or Compound and start exploring the services provided.

- Get Started: Either by trading, lending, or staking.

- Continuous Learning: DeFi is a rapidly evolving sector, so it’s crucial to keep yourself updated on the latest happenings and security best practices.

Staking 2025: Win from Staking and Increase your wallet

Practical Examples of DeFi

Platforms Having understood what is decentralized finance, it is impossible to ignore the major platforms that have shaped this field.

Platforms such as Uniswap, a decentralized trading platform that facilitates trading between cryptocurrencies; Aave, a platform offering lending and borrowing; and MakerDAO, a platform that facilitates the creation of stablecoins, are living testaments to the strength of DeFi.

If you’re interested in the best-known and highly successful DeFi projects offering passive income, then you have several platforms offering profitable returns.

Earlier, we talked about the top 10 DeFi projects you can earn income passively on, how they work, and how you can benefit. You can read the article to learn about the investment opportunities.

In the End:

While DeFi opens new doors for financial freedom and innovation, you must be aware of the risks you might encounter. From price volatility to security breaches, there’s always another side to the equation.

So, if you decide to join this world, proceed with caution and invest time in learning before committing any funds.

More importantly, remember that DeFi is still in its early stages, and its evolution depends on the people who participate in it and learn from it.

Whether you’re looking to explore investment opportunities or simply understand how the new financial system works, every step you take is part of this digital revolution. Are you ready to become a part of your financial future?

swapforless blog

swapforless blog